Facts speak louder than words

While financial markets operate on the basis of facts and data, investment decisions and capital flows are steered by meticulous market analysis. The issuance of the so-called “advisory” by the US government to US businesses and individuals operating in Hong Kong is simply an attempt to turn a blind eye to facts and stir up trouble out of nothing. Hollow, absurd and flimsy, the allegations they made are bound to fall on deaf ears and will not in the least weaken the position of Hong Kong as an international financial centre. These unfounded allegations will in fact achieve nothing but undermining the credibility of the US government. Following the stern rebuttals made earlier by the Chief Executive and other principal officials including the three Secretaries of Departments and a number of Directors of Bureaux, we have collated key data in relation to the various segments of our financial market to give people a clear picture of the unique advantages and bright prospects of Hong Kong as an international financial centre. As the saying goes, “Facts speak louder than words.” When these real key data and the unfounded allegations by the US government are placed side by side, one can easily see through the lies told and come to know the truth that the position of Hong Kong as an international financial centre is as solid as ever.

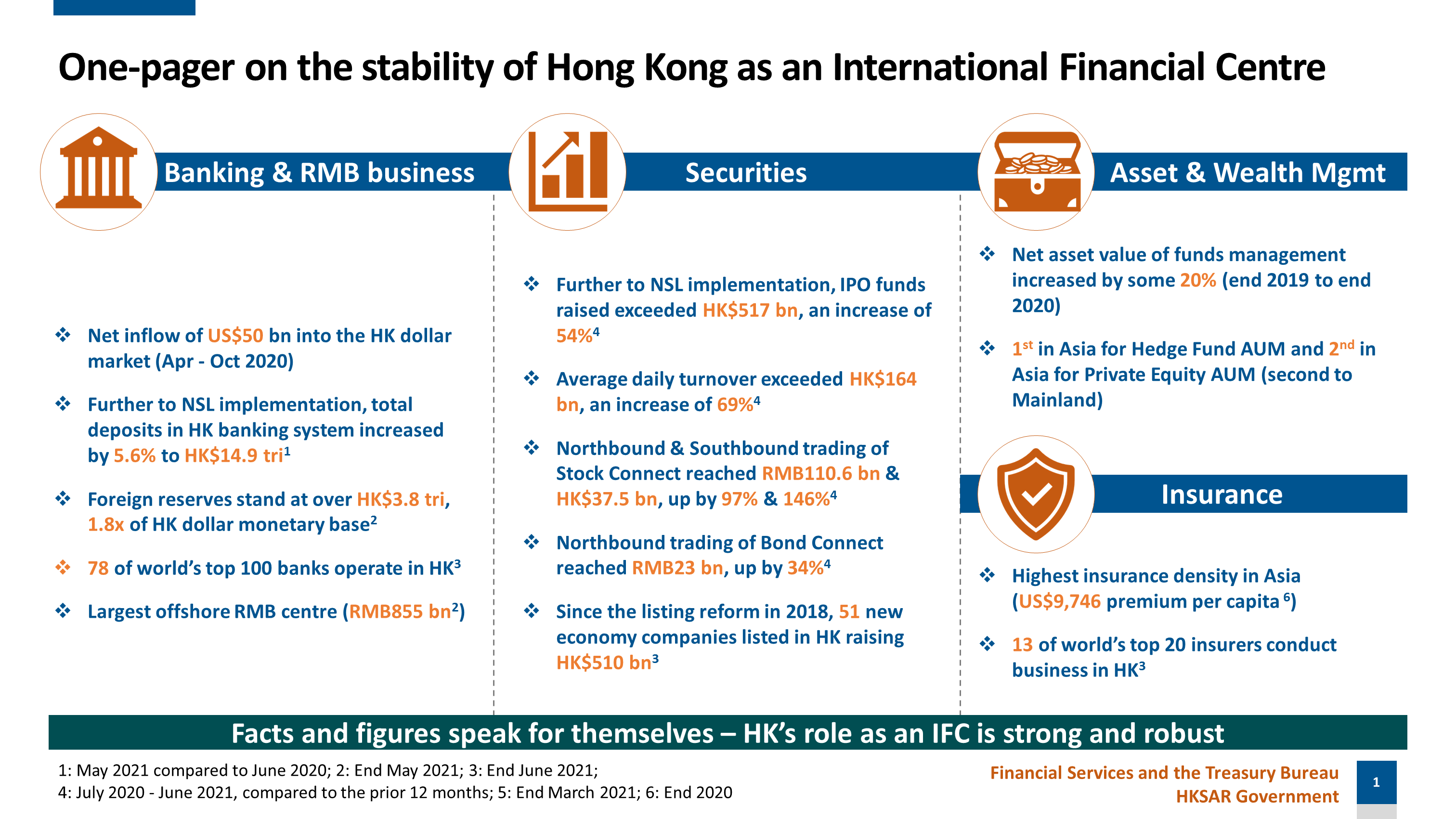

1. Solid foundation has attracted the inflow of capital: The Hong Kong dollar exchange rate has been staying strong since early 2020. Between April and October last year, the inflow of a total of about US$50 billion into the Hong Kong dollar system led to the triggering of the strong side Convertibility Undertaking, with US$42 billion of it flowing in after 1 July. At present, we have a foreign exchange reserve of more than HK$3.8 trillion, which is 1.8 times the amount of the Monetary Base of the Hong Kong dollar.

2. Continuous innovation has enhanced market capacity: Our capital market, which is good at grasping emerging opportunities, is enhancing its capacity through continuous innovation. Renminbi (RMB) internationalisation, the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect (the Stock Connects), as well as the reform of the listing regime in 2018 are some major examples. Such innovative opportunities have now yielded fruitful results in the Hong Kong market and become the growth engine for its continuous advancement. Hong Kong is the largest offshore RMB centre globally, with a liquidity pool of over RMB 850 billion. As for the Stock Connects, with the implementation of the National Security Law (NSL), the daily average turnovers of northbound and southbound trading amount to about RMB 110.6 billion and HK$37.5 billion, representing an increase of 97% and 146% respectively over the 12 months prior to the enactment of the NSL. Moreover, since the reform of the listing regime in 2018, a total of 51 new economy companies have been listed in Hong Kong under the new regime as at end-June, raising a total of more than HK$510 billion.

3. Connectivity with the Mainland and overseas countries has made Hong Kong an appealing place for businesses to establish their foothold: The financial market of Hong Kong has been operating under a well-established regulatory framework with international recognition. To Mainland and overseas financial institutions, Hong Kong has always been the preferred location for establishing presence and exploring opportunities for business connectivity. Among the top 100 banks in the world, 78 are operating in Hong Kong; and 13 of the top 20 global insurers are conducting business here. To further leverage our unique advantages arising from our connectivity with the Mainland and overseas countries under “One Country, Two Systems”, we will also take forward projects such as the Cross-boundary Wealth Management Connect in the Guangdong-Hong Kong-Macao Greater Bay Area and the Southbound Trading of Bond Connect in future.

Since the implementation of the NSL in last July, the vibrant, robust and buoyant financial market of Hong Kong has been offering huge opportunities to local and overseas market participants. With stability and order restored under the NSL, we now have greater confidence and resolve to explore new opportunities ahead, setting to bring the development of our financial market to new heights.